Spousal Rollovers and Stretch IRAs: Whenever a husband or wife inherits an IRA, they've the choice to roll it over into their own individual retirement account, retaining tax-deferred growth and creditor protection below ERISA.

In the situation of a lawsuit, Should you be required to pay out a claim, the umbrella coverage will appear into play Once your common legal responsibility insurance coverage has run out.

They provide a wide array of investment goods and account types, and take care of clients' portfolios to make certain development toward their goals. Their focus is on comprehending clientele' wants, addressing personalized alterations and sector shifts, and assisting purchasers make educated selections.

We offer ongoing steering and adjust methods as essential making sure that your asset protection system continues to be aligned with the monetary targets and evolving everyday living circumstances. Our asset protection services include:

In fact, having said that, a self-settled asset protection have confidence in comes with specified inherent hazards that additional classic have faith in autos don’t have. This isn’t to convey self-settled trusts are never wise alternatives or that you need to constantly stay clear of them. But it’s critical to be familiar with the full implications of equally have confidence in types before deciding on 1 or one other.

Some states present you with a homestead exemption that guards a percentage of your private home’s equity from creditors.

The federal authorities will likely not adjust any regulations related to bare minimum withdrawal procedures in the event of a lawsuit and may charge a ten% early withdrawal rate In case you are extracting money in response in your lawsuit.

Tax benefits: The premiums paid to fund the captive business are tax deductible bills. The quality bucks compensated on the captive insurance company are certainly not taxable for the corporation If your yearly rates tend not to exceed $2.two Million.

International or offshore asset protection trusts are known for their security, dependability, and Total effectiveness. But what about domestic asset protection trusts or DAPTs? Allow’s break down the advantages and disadvantages of domestic asset protection trusts in detail.

Retirement accounts have lots of further Advantages, apart from their effectively-identified tax positive aspects. This is excellent information for most Us residents, because it seems that one of the best ways to guard assets is usually to shield them in retirement accounts.

Regrettable Events Having sued is just a type of lifetime gatherings that no-one ideas for. Nonetheless, like divorce or the loss of a liked one, unlucky gatherings frequently have huge financial implications. The easiest way to contend with the prospect of the unfavorable predicament is to safeguard you within the possible pitfalls beforehand.

Real estate property is probably The main asset you own. That’s especially true if, like a significant Internet value person, Additionally you Bullion and coin investment companies possess real estate property not simply on your own but for investment applications in various states or unique international locations.

In a great world, each marriage would figure out in ideal harmony. But irrespective of whether you’ve previously been married and are attempting once more, or are obtaining married for the first time but are knowledgeable of contemporary divorce premiums, you realize that's often not the situation. It isn't unreasonable or cynical to consider how to safeguard your assets from divorce, particularly if you're a superior-Web-worth person and also you're acquiring married to another person with noticeably considerably less in terms of property or liquid money.

But if your company can be a constrained liability business, your personal assets are going to be safe and secure In case the lawsuit is productive. Only the organization’s assets is going to be at risk.

Kelly McGillis Then & Now!

Kelly McGillis Then & Now! Tahj Mowry Then & Now!

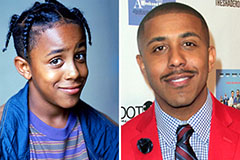

Tahj Mowry Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Melissa Sue Anderson Then & Now!

Melissa Sue Anderson Then & Now! Lisa Whelchel Then & Now!

Lisa Whelchel Then & Now!